What Makes Soybean CFDs Attractive?

Soybeans are among the most actively traded agricultural commodities in the world, and that liquidity directly translates into the CFD market. What does this mean for investors? It means tighter spreads, faster executions, and greater efficiency in entering and exiting positions. For institutional players and retail traders alike, this is a massive advantage. You can allocate capital to soybean CFDs with confidence that you’re entering a market that is vibrant and dynamic, not a backwater corner with unpredictable swings and limited volume.

Accessibility also plays a key role. Unlike traditional futures contracts that demand larger capital outlays and often come with steep learning curves, CFDs provide a more democratized approach. You don’t need a commodities trading license or to roll contracts manually every few months. You simply go long or short from your trading platform and react to market shifts in real time. For professionals and sophisticated investors with time-sensitive strategies, this level of ease is invaluable.

And let’s not forget about the globalization of trading platforms. With brokers now offering CFD access to commodity markets worldwide, trading soybean CFDs from a smartphone in Poznan or a desktop in Singapore is equally feasible. This global reach expands the investor base and further deepens market liquidity, creating a robust feedback loop that enhances performance.

Leveraged Exposure with Controlled Risk

Leverage is a double-edged sword, but in the hands of a disciplined investor, it becomes a precise instrument. Soybean CFDs offer leveraged exposure that allows you to control large contract values with a fraction of the capital outlay. In an inflationary environment where fiat is losing value and yield curves remain inverted, this can amplify returns smartly and strategically.

But leverage without risk controls is reckless. That’s where modern CFD platforms shine. With tools like guaranteed stop-loss orders, trailing stops, and margin alerts, investors have a comprehensive suite of risk mitigation tools. You’re not flying blind. You’re navigating turbulence with precision instruments.

And let’s talk strategy. Sophisticated investors often use CFD leverage not just for outright speculation, but also for tactical hedging. Say you’re long on agricultural equities or ETFs. A short position in soybean CFDs during volatile harvest reports or El Niño disruptions can cushion your drawdowns. The interplay between leverage and risk management creates a tailored exposure model that is unmatched in the traditional investing space.

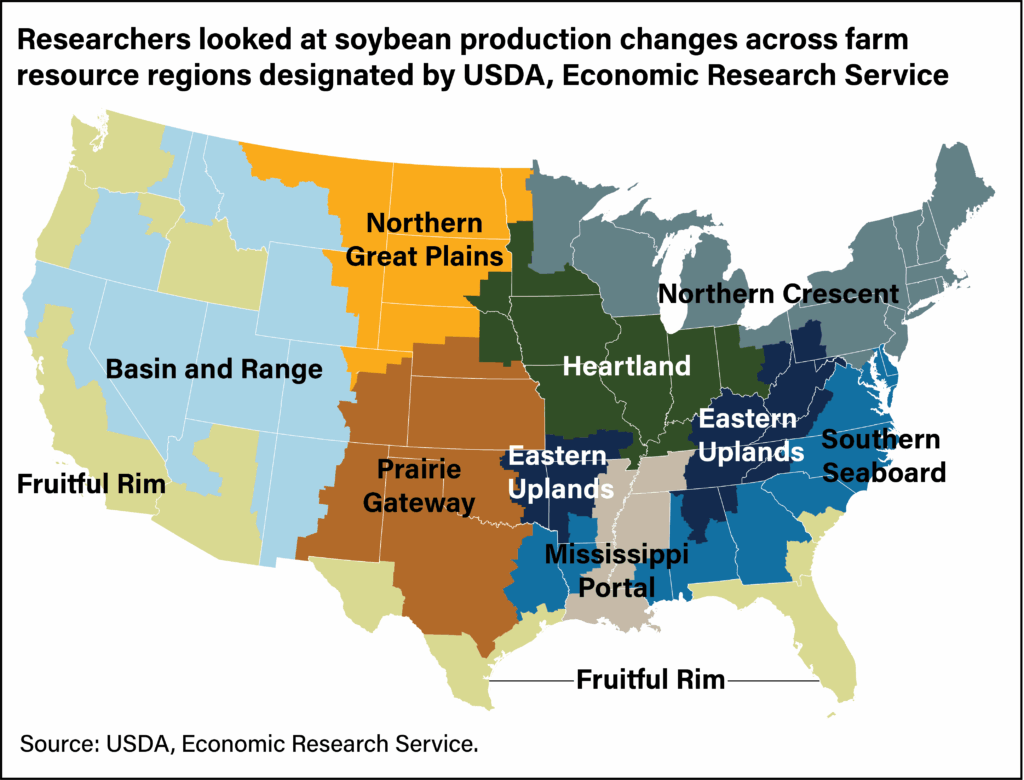

Time is money, and the ability to trade five days a week around the clock is a game-changer. Agricultural commodities are particularly sensitive to breaking news, from drought reports in Brazil to geopolitical developments in Ukraine or weather anomalies in the Midwest. Having round-the-clock access means you’re not waking up to a missed opportunity or a locked-out market gap. You can react in real-time, adapt, and pivot when it matters most.

This flexibility empowers active traders who thrive on intraday volatility, as well as long-term investors who want to scale in or out without being boxed into narrow windows of opportunity. It also reduces slippage and increases precision in execution, particularly around key macroeconomic releases or USDA crop reports that move the market.

Pair this with the speed of execution on modern platforms and the low latency of pricing feeds, and you have an asset class in soybean CFDs that aligns perfectly with the expectations of today’s high-performance investors. It’s no longer just about returns. It’s about timing, speed, and strategic access. And soybean CFDs deliver all three.

Climate Change and the Agricultural Shift

Climate change is not just a buzzword anymore as it’s a seismic force shaping the very fundamentals of global agriculture. Erratic rainfall patterns, prolonged droughts, and rising temperatures are disrupting traditional planting and harvesting schedules. This unpredictability is squeezing supply, creating the kind of volatility and scarcity that savvy investors can exploit through instruments like soybean CFDs.

Take South America for instance. Brazil and Argentina are among the top producers of soybeans, but they are also among the most climate-sensitive regions. When drought slashes output in Brazil, prices spike globally. And with climate events increasing in frequency and intensity, these supply shocks are no longer once-in-a-decade anomalies—they’re annual certainties.

That creates a perfect storm for investment. Because every time supply gets disrupted, price volatility spikes. And CFDs thrive in volatile environments. Whether you’re betting on a short-term squeeze or riding a long-term trend driven by shifting weather cycles, soybean CFDs give you the agility to adapt and profit.

Emerging Market Demand from Asia and Africa

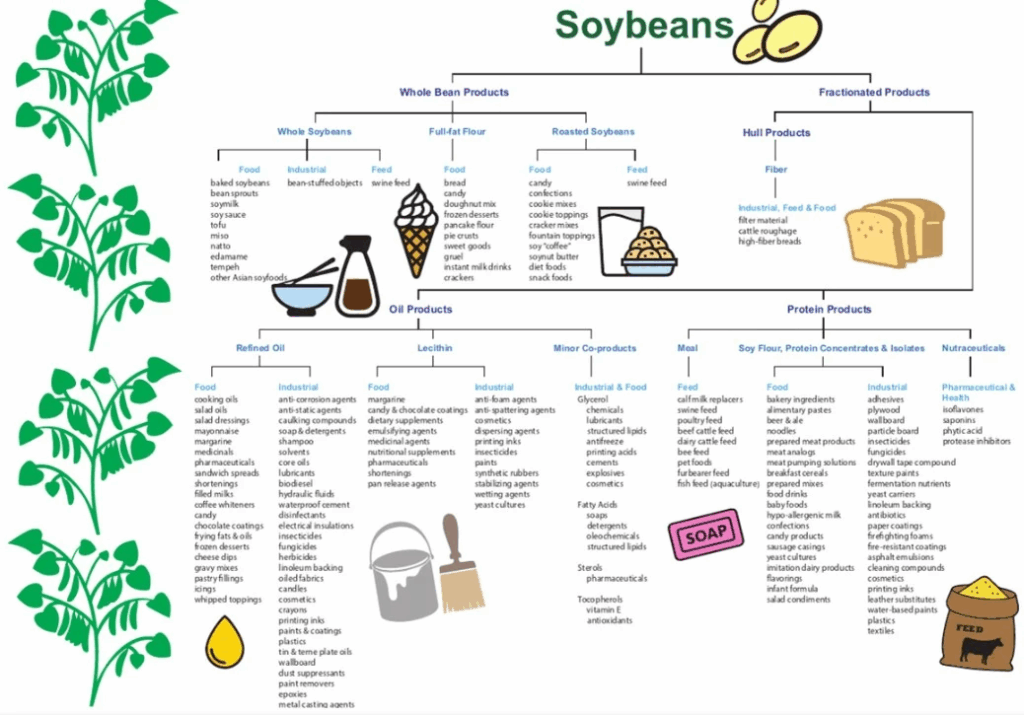

As developing economies grow, their dietary patterns evolve. Nowhere is this more evident than in Asia and Africa, where rising middle classes are driving an insatiable demand for protein. Soybeans, as a primary input for animal feed and plant-based meat alternatives, are at the heart of this nutritional transition.

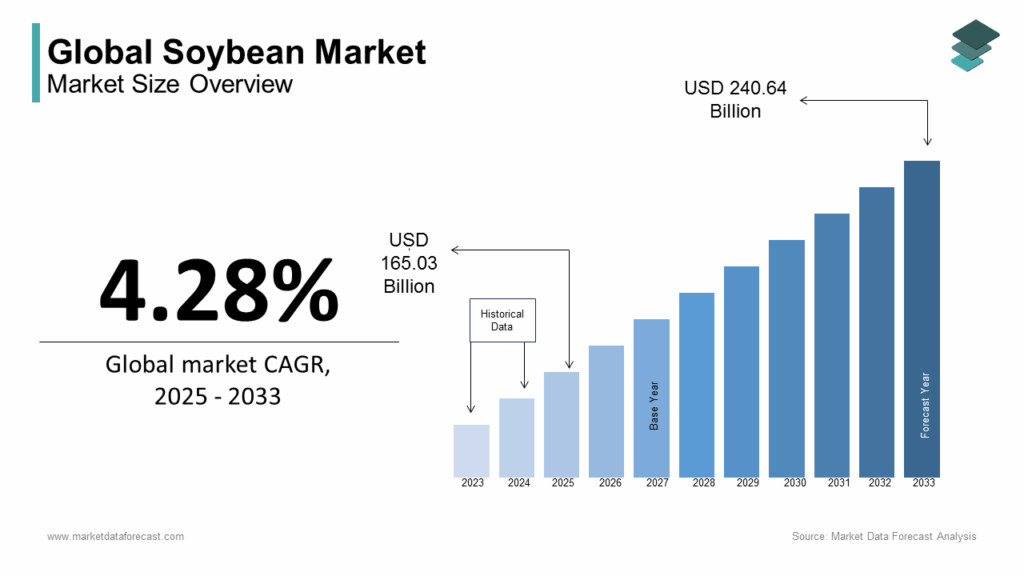

China alone consumes more than half the world’s soybean exports. Its urbanization and dietary modernization are irreversible trends. And while Africa currently lags in consumption, its population growth projections make it the sleeping giant of soybean demand. Between now and 2029, these markets will require massive imports of soybeans to feed livestock and fuel food production.

This is not speculation – it’s structural transformation. And when demand grows faster than supply, prices follow. For investors in soybean CFDs, this means repeated opportunities to capitalize on demand-driven price rallies. You’re not betting on hype. You’re aligning with unstoppable demographic and economic forces.

Trade Agreements and Strategic Alliances Impacting Supply Chains

Geopolitics is increasingly shaping the movement of goods, and soybeans are no exception. From the U.S.-China trade wars to the EU’s sustainability-driven import policies, global agreements can either open new markets or choke off supply overnight. These shifting alliances make soybeans a politically charged and economically sensitive commodity.

Consider this. If a major trade agreement collapses or tariffs are imposed, exporters like the U.S. or Brazil may redirect shipments to new buyers. That disruption doesn’t just shift logistics—it shifts prices. And it does so violently. CFD traders can position themselves to ride those waves, whether the market reacts with optimism or fear.

Even sanctions and subsidies play a role. Governments often step in to support local farmers or penalize foreign competitors. Each of these moves reverberates through soybean prices. For the informed CFD investor, that means fresh opportunities to trade each twist and turn of global policy with surgical precision.

How Soybean CFDs Fit into a Modern Investment Portfolio

Inflation is no longer a distant threat – it’s here and it’s redefining how portfolios are built. In this environment, soybean CFDs offer something that fiat currencies and overvalued tech stocks can’t real asset exposure. When the cost of living rises and central banks print money, hard commodities like soybeans tend to surge. Why? Because they’re essential. People don’t stop eating during inflation only they shift what they eat, and soybeans are often the answer.

Now factor in currency risk. If you’re trading in emerging markets or holding assets denominated in volatile currencies, soybean CFDs act as a counterweight. Since soybeans are priced globally in USD, they offer natural insulation against local currency depreciation. For European investors watching the euro wobble or Latin American investors battling currency devaluation, soybean CFDs can be an effective hedge that stabilizes your capital without parking it in low-yield government bonds.

It’s also about timing and responsiveness. Unlike traditional commodities like gold that may require longer holding periods and physical storage solutions, soybean CFDs can be adjusted within minutes to match the pace of inflationary movements. This tactical flexibility means you can hedge for a week, a month, or a quarter – whatever fits your strategy best. It’s like owning a Swiss army knife in a world full of blunt tools.

Most portfolios are overexposed to correlated assets – think tech stocks, REITs, or corporate bonds. When the market corrects, they fall in tandem. That’s why real diversification requires adding uncorrelated assets, and soybean CFDs are a powerful solution. They respond to weather patterns, crop reports, and geopolitical shifts, not earnings season or central bank rhetoric.

Let’s say you’ve built a solid portfolio of growth equities, some high-yield bonds, and a few ETFs. That’s great in a bull market. But what about when markets get jittery or global conflicts threaten equity valuations? Adding soybean CFDs introduces a unique risk-return dynamic. Their behavior doesn’t mirror the S&P 500 or the NASDAQ. That’s precisely what makes them valuable. They zig when your other holdings zag.

And it’s not just about defense. Soybean CFDs can also drive offensive growth. If you catch a bullish wave say, a weather crisis in Brazil or a surprise export surge from the U.S. still you can lock in gains that have zero relation to broader market performance. That kind of asymmetric alpha is what modern portfolios are missing. It’s not just diversification. It’s intelligent, adaptive investing.

In 2022 and 2023, many investors learned the hard way that traditional assets are more correlated than they thought. When the Fed raised rates and markets tanked, even so-called “defensive” stocks took a hit. This lesson set the stage for a renewed focus on uncorrelated assets and soybean CFDs fit the bill perfectly.

Why? Because their price movements are dictated by factors that have little to do with the stock market. Rainfall in Iowa, shipping delays in Argentina, and import tariffs in China have zero relevance to Apple’s quarterly results or Tesla’s delivery figures. That’s the magic of uncorrelation. When equity markets are melting down or stuck in sideways chop, soybean CFDs can still shine.

This independence from the macro-equity narrative gives savvy investors an edge. They can structure trades that move on completely different cycles, reducing overall portfolio volatility and increasing risk-adjusted returns. It’s not about abandoning equities. It’s about complementing them with assets that dance to a different beat.

The Strategic Timeline: Why 2026 to 2029 is Crucial!

The period from 2026 to 2029 is set to be a renaissance for agri-tech. Precision farming, AI-powered yield optimization, and gene-edited crops are moving from labs to fields. And soybeans are being one of the most studied and commercially valuable crops are at the epicenter of this revolution.

What does that mean for CFD investors? It means you’re not just betting on a commodity. You’re tapping into a tech-driven productivity wave that could reshape the entire supply curve. Higher yields might drive prices down in the short term, but that volatility creates trading opportunities. And if innovations fail to meet expectations or face regulatory delays, supply might tighten even further, pushing prices skyward.

Tech also brings better forecasting. With satellite imaging and AI modeling, market participants will get more precise data on planting acreage, soil health, and weather impact. This means sharper moves on data releases and better-informed trades. For CFD investors who can act on this information quickly, that translates to higher alpha and stronger performance.

Between 2026 and 2029, the world will face growing imbalances in food supply and demand. As climate change continues to disrupt growing seasons and urban expansion eats into arable land, producing enough soybeans to meet global needs will become increasingly difficult.

At the same time, demand from biofuel industries, especially in Europe and North America, is projected to rise significantly. Countries are doubling down on green energy, and soy-based biodiesel is a key component of that strategy. So you have surging demand on one side and a constrained supply on the other—a classic setup for price spikes and long-term uptrends.

For soybean CFD investors, these imbalances are pure gold. Every time a country releases a disappointing harvest report or a new regulation tightens biofuel standards, prices move—often sharply. This isn’t just theory. It’s a repeating pattern that can be exploited with disciplined strategy and timing. And between now and 2029, that pattern is likely to accelerate, not fade.

Governments around the world are rethinking their approach to agriculture. From subsidies to climate-related compliance rules, the regulatory landscape is increasingly commodity-friendly. And soybeans are right at the center of this shift. Whether it’s the EU pushing for cleaner farming methods or the U.S. backing soybean producers with support packages, the result is the same: more attention, more volatility, more investor opportunity.

These policies are not always rational, but they’re predictable. That’s what makes them powerful for traders. When a government introduces a new subsidy, it distorts market pricing temporarily. When export restrictions are lifted or imposed, global trade flows adjust, creating price momentum that can be captured through CFD trades.

Regulation doesn’t just add risk. It adds clarity and rhythm to market cycles. For soybean CFD investors, keeping a close eye on political developments can turn legislative noise into trading signal. And over the next four years, that noise will only get louder and more profitable.

When it comes to trading soybean CFDs, your broker is your battlefield. And not all brokers are created equal. You need one that offers tight spreads, high leverage (with risk controls), fast execution, and above all transparency. A broker that cuts corners on execution speed or slaps you with hidden overnight fees can erode your profits faster than a losing trade.

It’s not just about cost, though. Look for platforms that provide institutional-grade tools economic calendars, real-time news, risk calculators, and customizable alerts. These features aren’t gimmicks. They’re essential for navigating a fast-moving commodity market like soybeans where a single USDA report can shift prices by 5 percent in a day.

And don’t underestimate the value of regulatory oversight. Choose brokers licensed in major jurisdictions like the UK, Australia, or the EU. You want capital protection, segregated accounts, and recourse in case of disputes. A low-cost offshore broker might seem tempting but when markets get volatile, and you’re managing a five-figure trade, peace of mind is worth every basis point.

Profitable soybean CFD trading requires more than luck it demands discipline, strategy, and a blend of technical and fundamental insight. On the technical side, price action plays a huge role. Soybean prices often respect historical support and resistance levels, particularly around harvest and planting seasons. Use tools like Fibonacci retracements, moving averages, and Bollinger Bands to identify entry points and exit zones.

But don’t rely on charts alone. Fundamentals in the soybean market are equally, if not more, important. Crop yield forecasts, export data from Brazil and the U.S., global weather anomalies, and even oil prices (because of biodiesel demand) all impact soybean valuations. That’s why many successful traders combine both approaches using technicals to fine-tune timing and fundamentals to shape broader market bias.

Stay data-driven but nimble. The best traders aren’t the ones who know the most they’re the ones who adapt the fastest. Develop a thesis, track key drivers, and adjust when the story changes. That agility, more than anything else, will define your profitability in the soybean CFD space.

This is where the rubber meets the road. Because no matter how strong your analysis or confident your outlook, soybeans are volatile and leverage can magnify both gains and losses. That’s why risk management isn’t a side note. It’s the whole game.

Start with position sizing. Never risk more than 1 to 2 percent of your trading capital on a single trade. Use stop-loss orders religiously. And understand your margin requirements thoroughly. Commodities can move on a dime, especially in reaction to news out of Brazil, the U.S. Midwest, or China.

Also, know your exposure across asset classes. If you’re already long agricultural stocks or ETFs, layering on more exposure via soybean CFDs might over-concentrate your portfolio. The goal is to diversify intelligently, not recklessly.

And above all respect the market. Every trader hits losing streaks. What separates professionals from amateurs is how they handle drawdowns. Manage risk like a hedge fund manager, not like a gambler chasing a hot tip. Because in the world of soybean CFDs, the market rewards discipline and punishes ego.

Real-World Use Cases and Trading Scenarios

Soybean CFDs aren’t just tools for speculators they’re lifelines for agricultural producers, exporters, and food manufacturers. Imagine you’re running a soybean processing plant that buys raw soy from global suppliers. A price surge could eat into your margins overnight. With soybean CFDs, you can hedge that risk in real time shorting the CFD market to offset the cost of your physical inventory.

Likewise, large farms and cooperatives use CFDs to lock in prices before harvest. That way, they’re not hostage to market swings caused by weather or logistics. It’s smart business. And as risk management becomes more data-driven, the use of financial instruments like CFDs is moving from the trading floor to the farmer’s office.

This isn’t theory it’s happening now. Between 2026 and 2029, expect a surge in real-world CFD usage as agriculture becomes more digitized and risk-aware. If you’re in the sector and not exploring these tools, you’re already behind.

Every month, the USDA releases crop progress and supply-demand data. These reports can spark instant price swings in soybeans often double-digit percentage moves in a matter of hours. CFD traders who prepare in advance can capitalize handsomely.

Here’s how the pros do it. Leading up to a USDA release, they analyze consensus forecasts. If expectations are overly optimistic and there’s a risk of underperformance, they might position long. If the opposite is true, they short. And if volatility is expected either way, they straddle the trade using tight stops and multiple entry points.

What makes soybean CFDs perfect for this tactic is their flexibility. You can enter, scale, and exit with minimal friction. You’re not locked into large futures contracts or physical delivery obligations. It’s fast, efficient, and perfectly aligned with news-driven strategies.

Soybeans have one of the most reliable seasonal cycles in commodities. Prices tend to rise in spring and summer as planting begins and peak during late summer amid weather uncertainty. Then they cool off post-harvest in autumn. CFD traders who understand this rhythm can ride predictable waves year after year.

But it’s not just about the calendar. Within those cycles are micro-trends—like pre-planting rallies driven by weather forecasts, or late-summer spikes tied to export surges. Traders who study historical patterns and match them with real-time sentiment can develop powerful swing trading strategies.

This is where soybean CFDs really shine. Because you can go long or short at will, without the restrictions of futures expiration dates or contract rollovers. It’s like having a scalpel in a market that usually only gives you sledgehammers. Precision, speed, and pattern-based strategy this is the trifecta that separates hobbyists from professionals.

Conclusion

Between 2026 and 2029, the soybean market is going to be a battlefield of volatility, opportunity, and transformation. From macroeconomic tailwinds and geopolitical shifts to climate disruption and technological innovation, the landscape is ripe for strategic investors who know how to play the game. And there’s no more agile and high-impact tool in that game than soybean CFDs.

They offer access, leverage, flexibility, and real-world relevance. They let you hedge, speculate, or diversify with surgical precision. And most importantly they respond to forces that are only gaining momentum: global demand, food security, green energy, and the digitization of agriculture.

If you’re not looking at soybean CFDs as part of your strategy for the late 2020s, you’re missing one of the most asymmetric and high-potential opportunities in the modern financial markets. This is not a niche play. This is a macro trend hiding in plain sight.